Business: The single most important area that entails countless decisions as far as finances and taxes are concerned. One question that frequently arises: is life insurance a business expense? The answer is not always and it depends on the type of life policy for life coverage and business structure for tax deductions on life insurance premium. To reveal the tax position of this life insurance for any business, let’s take a deeper look at this topic.

Understanding Life Insurance as a Business Expense

In essence, life insurance acts as some sort of a financial backup, so that your close ones, or business partners are covered in case you die. But is this essential protection mechanism also possibly to be used as a business expense? More often than not, the response is negative. In particular, the IRS normally prohibits the insurance premiums of life policies to be claimed as a business expense unless there are certain rigorous guidelines followed. However, there are some aspects that are worth discussing more, as far as particular types of business structures such as S-Corps or LLCs are concerned.

When Are Life Insurance Premiums Tax-Deductible?

To most of the business people, this is an individual expenditure and as such does not qualify for the list of the business expenses that you can claim as allowable deductions. However, exceptions exist in certain scenarios:

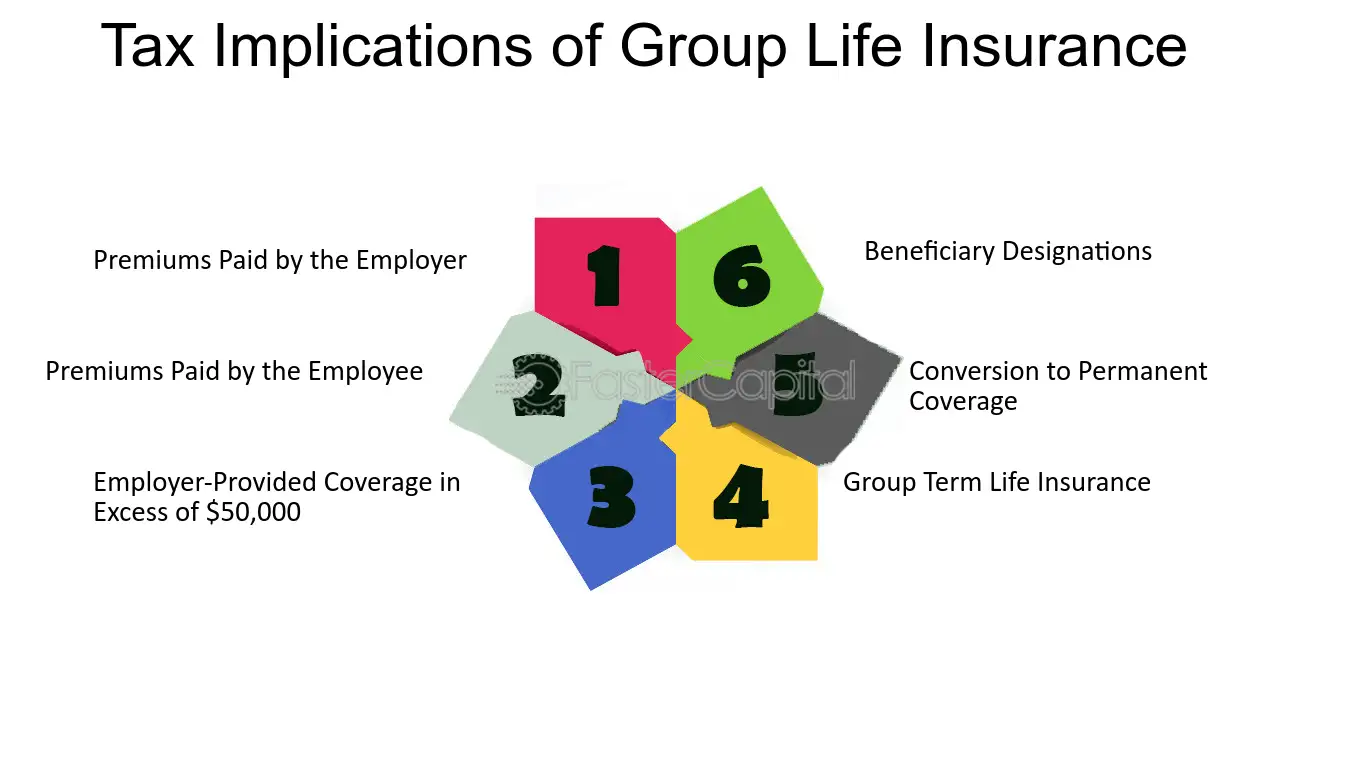

- Group Life Insurance Plans: In the case where you are able to provide life insurance for your employees as the benefit you extend to them, then you may find that the premiums paid on the life insurance policies available may actually be deductible. The coverage has to be afforded to everyone in the organization and the perks over $50,000 could become counted in another organizational fee for the workers.

- Key Person Insurance: If your business buys a life policy as an insurance against the loss of a key personnel, the premiums paid are not tax-deductible. However, the policy’s proceeds are usually tax-free which could provide much needed relief in the worst times.

How Business Structure Affects Deductibility?

The nature of your business is particularly helpful in defining whether or not life insurance can be classified as a deductible expense. Let’s break it down:

C Corporations

In the case of C corporations, premiums paid on contracts which the corporation or its owners are the beneficiaries of the policy, are not tax-deductible. The IRS has laid down some standard rules where such deductions are barred outright with no room for maneuver.

S Corporations and LLCs

S corporations and LLCs may have slightly more flexibility. To qualify for a deduction, the life insurance must be offered as part of a group plan available to all employees. Additionally, if the business owners are the beneficiaries, deductions are off the table.

Life Insurance Proceeds and Tax Implications

While premiums often don’t qualify as deductible expenses, the payout from a life insurance policy brings a silver lining. The death benefits received by beneficiaries are generally tax-free. This feature can make life insurance an attractive tool for transferring wealth or covering business debts in the event of a key individual’s death.

For businesses, this tax-free payout can be a lifesaver, providing capital to stabilize operations or hire replacements without worrying about income tax deductions eating into the funds.

Alternative Tax-Deductible Insurance Options

If life insurance isn’t a viable deduction for your business, other types of insurance might be. Here are a few examples:

- Liability Insurance: General or professional liability insurance is often deductible, helping cover lawsuits and other risks.

- Business Interruption Insurance: This policy covers losses during unforeseen disruptions, like a fire or natural disaster, and is typically tax-deductible.

- Commercial Property Insurance: Protecting your business assets and premises can also yield tax benefits, as premiums for these policies are deductible.

These alternatives provide robust protection while offering potential tax savings, making them worth considering for comprehensive financial planning.

Commonly Overlooked Tax Deductions for Small Businesses

Although life insurance premiums may not qualify as a deduction, small business owners can take advantage of several other deductible expenses. Here are some options to keep in mind:

- Home Office Expenses: Deduct a portion of your home’s utilities, rent, and maintenance costs if you work from home.

- Employee Benefits: Health insurance, retirement contributions, and wellness programs can be tax-deductible.

- Educational Expenses: Courses, training, and certifications directly related to your business can qualify for deductions.

- Travel Costs: Business travel, including flights, lodging, and meals, may be deductible if properly documented.

By optimizing these deductions, you can reduce your overall tax liability and retain more of your earnings.

Key Considerations for Business Owners

When deciding whether life insurance should play a role in your tax strategy, consider the following:

- Beneficiary Designation: If you or your business are listed as the beneficiary, deductions are unlikely.

- Coverage Limits: Policies with coverage exceeding $50,000 for employees may result in additional taxable wages.

- Long-Term Goals: While premiums might not be deductible, life insurance’s primary value lies in protecting your business and loved ones, offering peace of mind and financial security.

It’s essential to work closely with a tax professional to navigate these complexities and determine the best approach for your unique situation.

The Role of Life Insurance in Business Planning

Even without immediate tax benefits, life insurance remains a valuable component of business planning. Policies like key person insurance can shield your company from financial turbulence by providing much-needed liquidity in the event of a key employee’s untimely passing.

Additionally, offering group life insurance as part of an employee benefits package can attract and retain top talent, enhancing your company’s competitive edge.

Conclusion: Striking the Right Balance

So, is life insurance a business expense? While the answer is generally no, understanding the nuances and exceptions can help you make informed decisions. Although life insurance premiums may not lower your tax bill, they offer unparalleled protection and peace of mind for your business and loved ones.

When crafting your tax strategy, consider consulting with a seasoned tax advisor to explore alternative deductions and ensure compliance with IRS guidelines. By striking the right balance, you can secure your business’s future while maximizing financial efficiency.

Hi, I’m Lauren Reynolds, owner of Talks Smartly.

We specialize in wishes, thank you messages, and thoughtful responses for all occasions.

Whether it’s a birthday wish or a heartfelt thank you, we’re here to make your messages shine.

Join us at Talks Smartly and let your words leave a lasting impression.”